The 23 GST State Code is a crucial component of the Goods and Services Tax (GST) system in India. It plays a significant role in ensuring efficient tax compliance, simplifying the taxation process, and promoting a transparent tax regime.

Understanding the 23 GST State Code is essential for businesses engaged in GST registration, as it enables them to process GST returns accurately and calculate tax liabilities in accordance with the state-wise GST codes. By adhering to the GST rules and implementing the appropriate 23 GST State Code, businesses can avoid penalties while ensuring smooth operations within the Indian taxation system.

What is the 23 GST State Code?

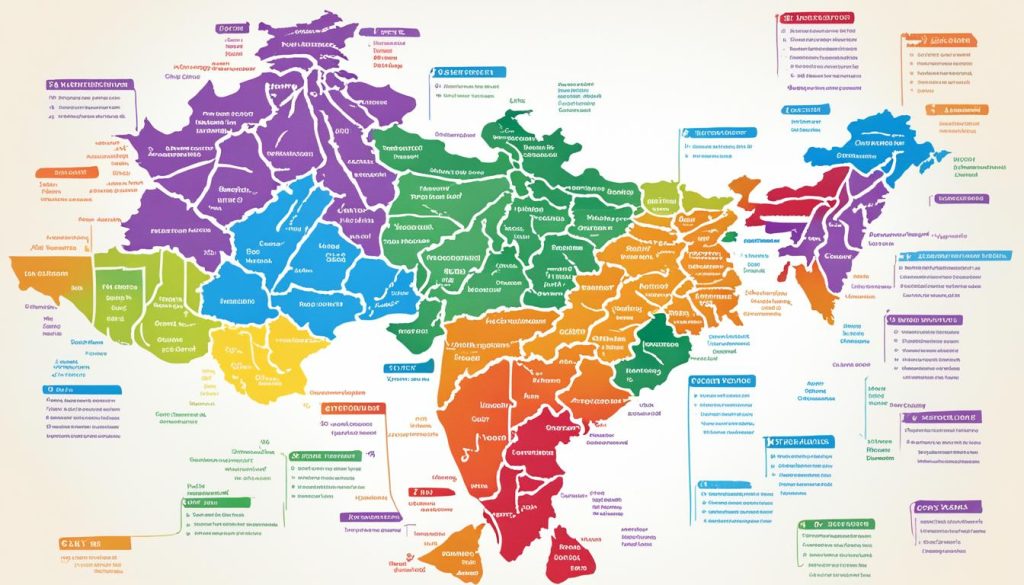

The 23 GST State Code is an essential component of the Goods and Services Tax (GST) system in India. Each state in India is assigned a unique code that is used to identify businesses registered within that state for GST purposes. In the case of Madhya Pradesh, the 23 GST State Code is specifically designated for businesses operating in this state.

The 23 GST State Code for Madhya Pradesh plays a crucial role in GSTINs (Goods and Services Tax Identification Numbers). It allows the authorities to identify and differentiate businesses registered in Madhya Pradesh from those in other states. This code facilitates the smooth processing of GST returns and assessments within Madhya Pradesh.

Businesses operating in Madhya Pradesh are required to ensure that they use the correct 23 GST State Code in their GSTINs. This adherence to proper coding is crucial for complying with GST regulations and avoiding penalties. The accurate representation of the Madhya Pradesh GST code in a business’s GSTIN is necessary for seamless reporting and tax compliance.

The 23 GST State Code for Madhya Pradesh is an integral aspect of the GST system, contributing to the efficient functioning and administration of the tax regime. Its correct usage helps maintain transparency and accountability in the tax system by accurately identifying the state of registration for businesses in Madhya Pradesh.

Benefits of 23 GST State Code

The 23 GST State Code brings several benefits to businesses and taxpayers in India. It simplifies the tax administration process, making it easier for businesses to register for GST and comply with GST regulations. The code also streamlines the processing of GST returns and assessments, ensuring accurate tax calculations and reducing the risk of penalties.

By using the 23 GST State Code in their GSTINs, businesses can easily identify their state of registration, making it simpler to determine the applicable tax rates and comply with state-specific regulations.

How is the 23 GST State Code used in GSTINs?

The 23 GST State Code plays a crucial role in the formation of Goods and Services Tax Identification Numbers (GSTINs). A GSTIN is a unique identification number assigned to businesses that are registered under the Goods and Services Tax (GST) regime in India.

Every GSTIN consists of 15 alphanumeric characters and is designed to provide a unified identification system for businesses across the country. The first two digits of a GSTIN represent the 23 GST State Code, signifying the state or Union Territory where the business is registered.

By incorporating the correct 23 GST State Code in their GSTINs, businesses can ensure the accurate identification and processing of GST transactions. The 23 GST State Code helps tax authorities determine the jurisdiction for a particular GSTIN and facilitates seamless compliance with GST regulations.

Furthermore, the GSTIN, with the inclusion of the 23 GST State Code, serves as a unique identification number for businesses, streamlining the GST registration process and enabling effective administration of the tax system. It provides businesses with a standardized format for representing their GST identification details, simplifying interactions with government agencies, and fostering enhanced transparency in the taxation ecosystem.

Difference Between the Madhya Pradesh State Code and 23 GST State Code?

When it comes to understanding the tax system and GST compliance in India, it is crucial to distinguish between the Madhya Pradesh State Code and the 23 GST State Code. While both codes are related to taxation, they serve different purposes and have specific applications in the GST registration process.

The Madhya Pradesh State Code is a numerical code assigned to the state of Madhya Pradesh for administrative purposes. It helps in identifying the state and its corresponding government departments. This code is used outside of the GST framework and is relevant in various non-GST transactions, such as government registrations, licensing, and statutory compliance.

On the other hand, the 23 GST State Code is specifically used in GSTINs (Goods and Services Tax Identification Numbers) to identify businesses registered in Madhya Pradesh for GST compliance. This code is part of the GST registration process and plays a crucial role in determining the state-wise GST codes. It ensures that businesses are correctly categorized and accounted for in the GST system.

It is important to note that the Madhya Pradesh State Code may differ from the 23 GST State Code. Therefore, businesses must ensure they use the correct 23 GST State Code in their GSTINs to comply with GST regulations accurately. Using the wrong state code can lead to non-compliance and create complications during GST filing and audits.

Understanding the difference between the Madhya Pradesh State Code and the 23 GST State Code is essential for businesses operating in Madhya Pradesh. By ensuring the accurate use of the 23 GST State Code in GSTINs, businesses can maintain GST compliance, streamline their tax processes, and avoid potential penalties and legal issues.

Can 23 GST State Code Be Used for Transactions Outside Madhya Pradesh?

While the 23 GST State Code is primarily associated with Madhya Pradesh, businesses often wonder if it can be used for transactions outside the state. Understanding the applicability of the 23 GST State Code in interstate transactions is crucial for maintaining compliance with GST regulations and ensuring accurate tax calculations.

For businesses engaging in interstate transactions, it is important to consider the appropriate GST tax types based on the nature of the transaction. Transactions within the same state may involve the use of Central GST (CGST) and State GST (SGST) tax types. However, when the transaction occurs between different states, Integrated GST (IGST) comes into play.

The Practical Application of 23 GST State Code in Business Operations

Understanding the practical application of the 23 GST State Code is crucial for businesses operating in India. This unique code plays a critical role in various aspects of business operations, including GST registration, compliance, and seamless tax identification.

One of the primary applications of the 23 GST State Code is in the process of GST registration. When businesses register for GST, they are required to provide their GSTIN (Goods and Services Tax Identification Number) which consists of 15 digits. The GSTIN contains the 23 GST State Code, as well as other essential information such as the entity’s PAN (Permanent Account Number).

Furthermore, the 23 GST State Code is an integral part of invoicing and filing GST returns. Businesses must mention the correct state code on their invoices to ensure accurate tax calculation and compliance with state-specific regulations. In addition, while filing GST returns, businesses need to include their GSTIN, which includes the 23 GST State Code, for the relevant state.

Complying with GST regulations is essential for businesses to avoid penalties and operate smoothly. The 23 GST State Code helps businesses adhere to state-specific compliance requirements. By incorporating the correct state code in their GSTIN, businesses can ensure that their transactions are processed without any complications.

In summary, the 23 GST State Code plays a significant role in business operations, specifically in GST registration, invoicing, filing GST returns, and compliance with state-specific regulations. Businesses must accurately incorporate the 23 GST State Code in their GSTINs to ensure seamless processing of GST transactions and compliance with state regulations. By understanding and implementing the 23 GST State Code in their business operations, businesses can maintain smooth GST compliance processes and avoid penalties.

Conclusion

In conclusion, understanding the 23 GST State Code is crucial for businesses operating in India’s tax system. The correct use of this state code in GSTINs is essential for complying with GST regulations, processing GST returns, and ensuring accurate tax calculations. By familiarizing themselves with the practical application of the 23 GST State Code, businesses can navigate the complexities of the Indian tax system and maintain seamless compliance with GST laws.